The 2012 CEO survey conducted by IBM gives some interesting insights. Seventy-three per cent CEOs are gearing their organizations to gain meaningful insights from customer data. This is the area of highest investment. The traditional approach to segment customer data to calculate statistical averages has been replaced with understanding the attitudes and tastes of individual customers.

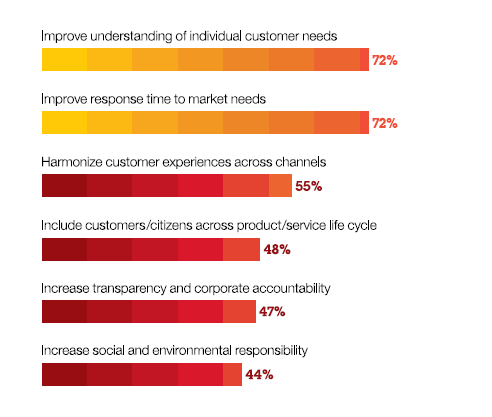

The main aim of gathering holistic customer information is to devise services and products targeted at the customers and improve the response time. As stated in the report – “The challenge for organizations is two-fold: can they pick up on these cues, especially if the information comes from outside? And can the appropriate parts of the organization act on the insights discovered?” The graph depicts the main reasons for capturing customer information.

Further, the report mentions, that though most of the CEOs focus on capturing information, out-performers excel at acting on insights. The difference is innovation and execution. A quarter of the CEOs reported that their organizations are unable to derive value from the data. Speed of action is required to capture data, analyse, prepare strategies and respond to customers. As one CEO stated the most crucial characteristic is to “organize a major wake-up call.” The customer obsessed CEOs are driving the organizations to more contextual customer insights. The graph below highlights the marked difference in under-performers and out-performers.

Risk managers can play a pivotal role in helping CEO’s achieve these objectives. They can focus on the following.

1. Organization Culture and Process Change

A customer oriented organization culture is required to leverage the opportunities. Secondly, the organization needs to align the processes towards customer relationship management. Risk managers can conduct organization culture survey to assess customer orientation. Moreover, they can review processes to determine risks and controls to mitigate risks.

2. Security of Data

The activity requires accumulation of extensive customer personal information. Generally, companies use separate data centres to collect and analyse the data. However, the risks of loss and theft of data is huge. As in the recent case of Facebook 1.1 million users’ data was sold for US $5. Therefore, it is a good idea to review security polices and test data centre security.

3. Return on Investment

Data collection requires huge investments in technology and resources. As the CEOs are saying the failure rate is quite high. A review of projects, plans and strategy would identify the pain points and misdirected activity. Calculating return on investment on various programs might steer the investments in the right direction. Timely identifying failing projects and reasons for failure is critical to maintain cost effectiveness.

Closing thoughts

Technology and social media has brought customers closure to companies. The face-to-face customer interaction is gradually shifting towards social media. The companies that are able to navigate this transition successfully will outperform their peers in the industry. Hence, risk managers should support this CEO initiative to enable the organization to leverage upside risks.

What is your organization doing in this respect? How do you think risk managers should facilitate CEOs in this initiative?

References:

You must be logged in to post a comment.